Commercial real estate (CRE) data analytics uses data to give real estate investors actionable insights to find investment opportunities and improve a portfolio.

While some may see data science or analytics as just a buzzword, it’s so much more. CRE analytics can answer many questions including:

- Is right now a good time to invest?

- How well are my investments performing right now?

- If my investments are down, when can I expect them to recover?

Data science in the real estate industry also combines machine learning and data visualization. Analyzing data is essential for real estate investors and managers to efficiently manage, advertise, and grow their commercial space.

What is real estate data analytics?

When deciding on real estate, accurate data analytics is essential to lower your risk. Real estate data analytics lets realtors and investors make data-driven decisions when buying, selling, or renting. The analytics can tell you more about a property’s investment potential, the local area, and help you find suitable tenants.

Commercial real estate data analytics provides a competitive advantage as it can help to lower the risks of purchasing and selling an asset. Without accurate data, CRE professionals run the risk of uninformed investment decisions.

Where to get real estate data

Getting high-quality, accurate real estate data for analysis is the first and most important step.

Business intelligence software provides data for real estate analysis. The types of data and tools available vary depending on the provider.

How real estate business intelligence software works

To analyze data, realtors use business intelligence (BI) software. The software collects data from many sources – these can be footfall data, local demographic data, market research, etc. All of this data is processed within the software and then displayed in a reporting platform for easy, efficient analysis.

Real estate business intelligence software data points

Saying “use the data” isn’t quite specific enough when you’re making big decisions such as selling assets. Business intelligence software collects the right sort of data for you, though each provider may vary on what is collected, how, and the accuracy of their models. When choosing software, look for:

- Geospatial data: location data including footfall

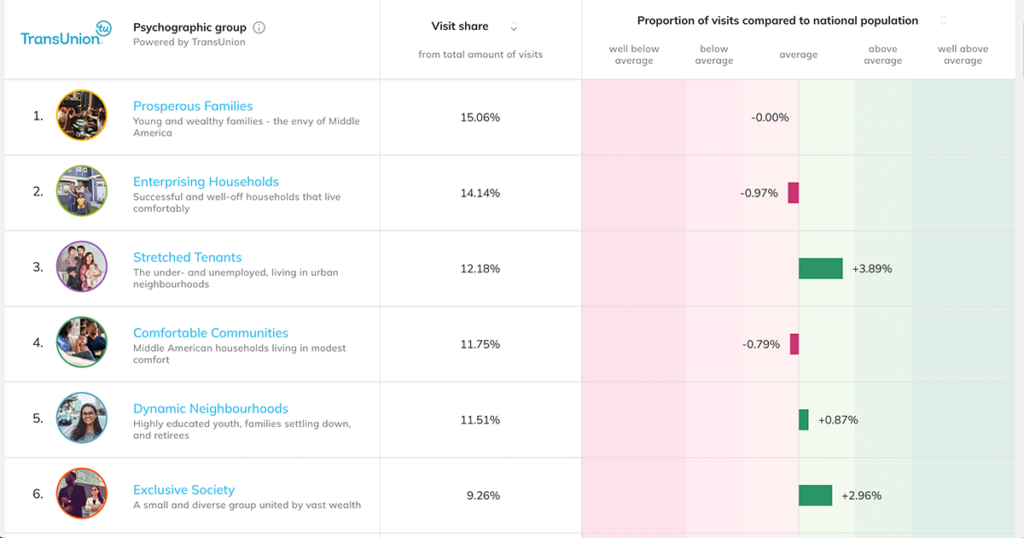

- Psychographic data: insights into the interests, values, and insights on local demographics

- Demographic data: the age, economic, and education level of people within the search area

- Transport data: how people in the area travel such as public transportation, cyclists, and drivers

- Crime statistics

- Nearby property values

- Nearby rental rates

Investment analysis for real estate decisions

Data-driven real estate means improved decision-making when investing in new CRE locations, store expansion, and finding new tenants. Let’s run through each of those to see how data can help.

Real estate data for acquiring new properties

Data can help you discover and evaluate a new property for investment. Using data can help you compare potential properties as well helping you make a final decision based on analysis.

When analyzing new properties, data the three big things you should look for are:

- Foot traffic: How many visitors does the property and area receive? Look at the foot traffic numbers over time and analyze how well the property is performing. Depending on the type of property you’re looking for, low footfall could be a curse or blessing.

- Local demographics: Anonymized data can tell you about the locals such as their level of income, education, and age ranges. This can give you a quick idea of what local visitors you can expect and if the property fits what you’re looking for.

- Popular areas: Sometimes you need to look at the bigger picture for a more detailed view of investing. For example, what retailers are popular, and which areas nearby draw in the most people? Quickly learn about the local area to make an informed choice.

When looking at new properties, using a data platform is ideal as it organizes the data and can produce reports for you. To present the data to clients or simply for easier visualization, real estate data analytics tools are essential.

Real estate data analytics for finding new tenants

Got a commercial real estate property and need to find a new tenant? It can be tough to make a decision. Data analytics tools can provide all the details you need, visualize them, and offer predictive insights using machine learning.

- Recommended tenants: Data now allows you to see predictive insights on which potential tenants would perform the best at the property in a ranking system.

- Current tenant analysis: Whether it be your property’s neighbors or tenants within the shopping mall, take a look at how nearby tenants are performing – which ones are on an upward or downward trend?

- Foot traffic: Take a look at the footfall of nearby properties, particularly those of a similar type. Our analytics platform also provides predictive data for the next 90 days

To find suitable tenants, you’ll need accurate data on your side and a good comparison system to ensure you can see all of the best options available to you. See our guide to filling retail vacancies for our step-by-step method.

Commercial real estate analytics for retail decisions

Commercial real estate data analytics is the process of examining raw data to extract useful insights about consumer behavior and trends. These insights pave the path for smart, data-driven decisions that can boost your retail business’s performance.

CRE data is used in retail for these scenarios:

- Guiding store closures

- Store expansion decisions

- Optimizing store open hours

Guiding store closures

Firstly, let’s consider the scenario of store closures. No business owner ever wants to shut down a store, but sometimes it’s a necessary step towards preventing larger fiscal losses. With commercial real estate data analytics, you can steer this tough decision-making process. Here’s how:

- By analyzing customer footfall patterns, you can identify underperforming locations that show a consistent lack of customer traffic.

- Reviewing sales data per location can highlight stores failing to meet revenue targets over a significant time period.

- Using demographic data, you can examine whether the local population aligns with your target market. If not, it might suggest a poor location choice for your store.

- Note the market saturation data – it could be that there are too many similar businesses in the area, leading to reduced profitability.

- Consider property value trends – if these are declining, it could indicate a lowering demand in the area, signaling that it might be time to close the store.

Benefits of data analytics in real estate

Data analytics drives better commercial real estate investing by helping investors and estate managers avoid costly decisions.

Real estate is the largest asset class in the world – worth more than all stocks and bonds combined – yet it is one of the last to adopt technology.

Louisa Xu, Partner at IVP

Using data, particularly as competitors fall behind in the adoption of technology, can give investors an edge.

An MSCI report found that real estate companies that implement big data saw a performance boost of 3-6%. It is a valuable tool that, when implemented, can quickly improve performance.

Applications of data analytics in the real estate industry

Commercial real estate data analytics aims to back up decisions with data to make tough choices clearer and informed, rather than ones based on intuition. Data can transform the way you view investment opportunities and manage risks.

There are three main use cases for data analytics, including identifying market trends, site and investment planning, and gaining a better understanding of consumers or local demographics.

Identify market trends

Data analytics can be used to identify trends in the commercial real estate market, such as changes in foot traffic, prices, rental rates, and demand.

This information can help investors make more informed decisions about where and when to invest, how investments are performing, and how a portfolio could be improved.

For example, if data shows that a particular neighborhood is experiencing rapid price appreciation, an investor may want to consider investing in that area.

Site planning

Data can reveal further details on the best sites for a retail store expansion or show which ones are underperforming according to industry benchmarks and your competitors.

Data for site planning can include transport information, such as local public transport links. Look for the usual methods of transportation of consumers within a specified area, along with the bus routes and any nearby train stations to estimate any passing trade.

Enriched understanding of consumers

Psychographic data reveals a detailed overview of the local population, including details of their regular visits to sites and the scale of their wealth. This data is collected into groups for easy categorization–allowing further research in the real estate sector while respecting privacy considerations.

An enriched understanding of consumers can help you understand what drives them and how to draw them into your commercial space.

Where and how to get real estate data

Real estate data for analytics in real estate is available from many sources, but few sources offer solid data of accurate and good quality. When searching for commercial real estate data, look for:

- Private and anonymized: privacy should be at the heart of any data platform. Look for a solid privacy policy that respects consumers and gets data from trustworthy sources.

- Recent data: Outdated datasets are of no use. Look for platforms using the latest technology to provide daily data sets.

- Predictive insights: Machine learning and AI can provide actionable insights based on the data to help you make decisions. This technology should be available and built-in ready to view in the platform’s reporting tools.

- Accuracy: The data should be provided from multiple sources with strong internal checks for validation and include ground-verified data.

To see how data can support your operations in real estate and retail, speak to our team today.

Real estate data analytics FAQs

How is data analysis used in real estate?

Data analytics in real estate is used when brokers, agents, investors, and operators are looking for current, relevant, and accurate information to make informed decisions.

Data analysis is completed regularly to:

- Provide up-to-date demographic, geospatial, and footfall information

- Report on the success of marketing campaigns

- Complete a heatmap analysis

- Make predictions and projections on revenue

- Find the right tenant

- Analyze the performance of a shopping mall

Can data analytics predict the future of commercial real estate?

Commercial real estate has seen troubled times in recent years. The pandemic caused a rise in work-from-home (WFH), which disrupted many offices and retail companies.

Investing in data analytics, systems, and infrastructure can give CRE companies an edge as predictions can be made with high accuracy in many cases such as:

- The potential success rate of a tenant in a mall vacancy

- Completing void analysis

- The future foot traffic expected in a retail space

- Whether an asset is performing as expected or below an industry benchmark