What is competitive intelligence?

Competitive intelligence is the strategic process of gathering and analyzing data on your competitors or wider market. It is also referred to as CI or corporate intelligence.

Over 90% of Fortune 500 companies use competitive intelligence in their business strategy.

Your competitors are probably already researching you. If you don’t gather competitive intelligence, you risk falling behind and losing market share.

To complete competitive analysis, many companies hire a competitive analyst while others contract on a project-by-project basis or complete the analysis in-house as needed.

Types of competitive intelligence

Competitive intelligence can be split into two main types: tactical and strategic. Companies use both but deploy one or the other depending on the type of intelligence the company requires.

| Tactical | Strategic |

| Short-term | Long-term |

| Inform day-to-day tasks | Inform strategy and long-term business plans |

| Research competitors and market in the present | Research current and historical trends of competitors and market |

| Particularly useful for the sales department | Useful for all departments and overall business strategy |

| Example: calculate market share | Example: tracking news and company updates within your sector |

Whether you use tactical or strategic competitive intelligence, both offer an opportunity to inform your business and strategy to gain an advantage.

What is competitive intelligence analysis?

Competitive intelligence analysis (CIA) is the process of collecting and analyzing data about key competitors and your marketplace to enable strategic decision-making. Some examples of analysis include:

- Website analysis: If a competitor changes their website, Ctas, or jumps up in SEO rankings, competitive intelligence analysis lets you know and adjust your strategy accordingly.

- News: What are your competitors doing? New executive leaders and directors, a change in branding, partnerships – all these are important updates to now and watch carefully.

- Pricing: The price of your products versus your competitors and any special offers they have available can impact your sales. Sometimes, a lower price point or discount is all the reason needed for your customer to switch to a competitor.

What is the competitive intelligence process?

Gathering CI is a process that repeats itself. Gathering competitive intelligence should never be done just once. The process typically follows six steps:

- Definition: Gather data by identifying and defining who your competitors are, along with the goals of your intelligence gathering.

- Research: The second step is all about collecting further details using search engines, social media, foot traffic data providers, and other tools.

- Analysis: With the data collected, now you can analyze your key competitors and market.

- Recommendations. Competitive intelligence can inform your company’s next steps this coming quarter, next year, or be the foundation of a 5+ year plan.

- Action: What is the end goal of your intelligence gathering? Think about the action you want to take and how you want customers to respond. It can be to build brand loyalty and connect more with your customer base.

- Optimization: What next? Competitive analysts should look for feedback, ways to make the process more precise for future use, and stay alert for any rising or falling competitors as time goes on.

How to gather competitive intelligence

Competitive intelligence can be gathered by observing your competitor’s activity, website, content, social media, stores, and performance.

Follow these four steps to gather intelligence:

- Identify competitors

- Analyze market share

- Customer demographics

- Create competitor profiles

1. How to identify your competitors

The first of completing competitive intelligence is identifying your direct and indirect competitors. Factors to consider are:

- Customer demographics

- Business size

- Competition level

- Store locations

Identify your direct competitors by looking at:

- Online communities: What are customers saying online? Customers may leave reviews or comments on social media suggesting alternatives to a competitor, which can give you further insight.

- Market research: What companies are selling similar products or have a similar customer demographic?

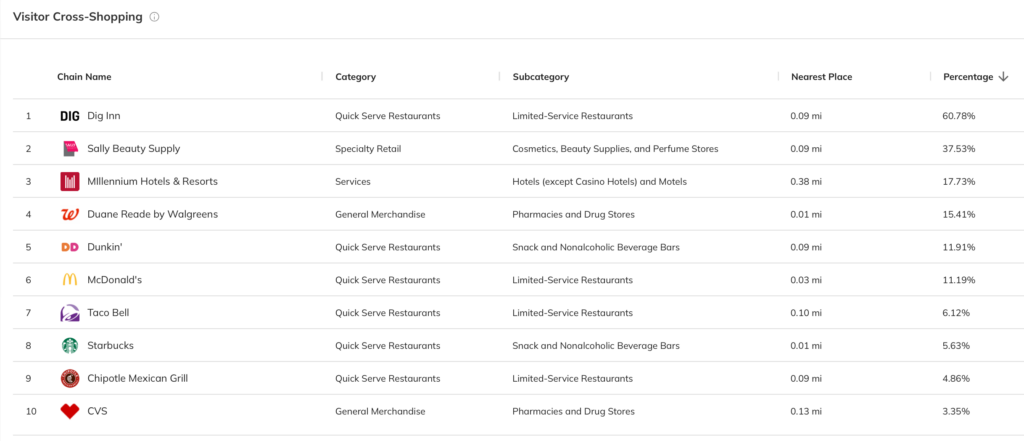

- Visitor cross-shopping: Data platforms can provide information on stores or locations your customers also visit. These can be direct or indirect competitors.

2. How to analyze market share

Market share is the percentage of an industry, sector, or total market sales from a company over a set time period. It is calculated by dividing the company’s sales over the chosen time period by the number of sales in the industry within the chosen time period.

The higher the percentage, the greater the number of sales and dominance a company has within its market.

For example, if a company sold $400 million in furniture last year in its domestic market, and the total volume of furniture sold in the domestic market was $800 million, then the company’s market share for furniture would be 50%.

To calculate market share, you will need to know the total number of sales within the market and the sales of the competitor. Find this information via:

- Business publications

- Company PR

- Yahoo Finance

3. How to get competitive intelligence on consumer demographics

Market share can tell you which companies have the biggest influence in your space and who your potential customers are flocking to. But it doesn’t give you details on customer demographics, what they want, or their value add.

Once you’ve found the key customer demographics, you can build out customer segments to better target your campaigns.

In-store customer demographics

To find in-store or offline customer demographics, look for a foot traffic data provider. Select the competitor, location, or area you need to analyze.

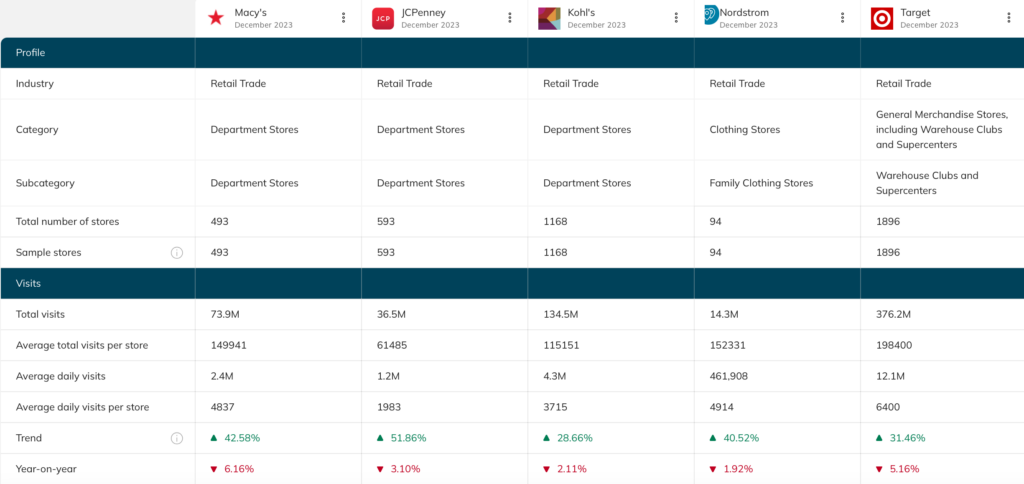

Using Almanac, our data platform, you can gather competitive intelligence on multiple competitors in one swoop. This tells you how many visits your competitor has had in a set time period, key customer insights, and overall performance.

Sign in to Almanac for competitive intelligence data.

4. Create competitor profiles

Now it’s time to gather up the data you’ve collected and enter in a couple of basic but important details.

- Number of employees

- Market share

- Management team names

- Product categories

- Total revenue, funding, etc

- Website URL

This information can then be shared via the cloud across teams for greater internal awareness of your competitors.

Methods of competitive intelligence: tools and tips

You can reliably collect competitive intelligence data yourself using search engines, checking company websites, and looking for reviews. Here’s a quick breakdown of some of the biggest ways to collect CI and examples of each.

| Method | Example |

| Company website | Content, SEO rankings, website design |

| Reviews | Customer reviews and reviews from employees for insights on satisfaction or retention |

| Ads | Design, performance, and what products are being promoted to who |

| Newsletter | Newsletter open rates, content marketing, and campaigns being pushed |

| Foot traffic data | In-person visits (historical and predictive) |

Monitor and assess competitor actions

Can you predict your competitor’s next move? That’s a million-dollar question! With competitive intelligence, you may not turn into a fortune teller, but you can certainly get a bearing on your rivals’ future strategies. By closely observing their actions – from product launches, marketing activities, to partnerships and acquisitions – you start to understand their game plays. Often companies telegraph their strategies in these activities.

Stay alert to market signals

Keeping an eye on the market and industry news is crucial. This can give early signals of a competitor’s forthcoming product launch, strategic partnerships, or even financial troubles. Sign up for newsletters, follow industry influencers on social media, and use media monitoring tools. The earlier you pick up these signals, the faster you can plan your counter-move.

Tune into their marketing communications

Examine your rival’s marketing and branding efforts. Do they highlight certain product features or price points in their ads? What tone do they use? What platforms are they most active on? Such cues can reveal their target audience, pricing strategy, and promotional tactics. Be vigilant to subtle changes in their messaging as it can indicate a change in strategy or positioning.

Evaluate competitors’ online presence and SEO strategies

Competitive intelligence doesn’t just involve observing real-world actions, but also understanding your competitor’s digital footprint. How visible are they online? What’s their SEO strategy? Which keywords are they optimizing for? Remember, being able to find your competitors online is crucial.

Investigate competitor social media activities

No business can overlook the power of social media today. It’s a direct line to consumers’ hearts and minds. Analyze your rivals’ social media activities – the platforms they use, frequency of posts, content type, engagement levels, and follower growth. These insights can help shape your own social media strategy.

Competitive intelligence tips

- Search Reddit: Find results for your competitor company via Google’s search engine by entering “site:reddit.com [competitor name]”. You can get more details such as including “reviews” after the competitor’s name.

- Form Q-10: publicly traded companies submit these forms every quarter. The documents can include details within the Risk Factors section on company weaknesses along with other financial position details.

- Google Alerts: Updates on your search query sent straight to your inbox.

- Use social media: TikTok, Facebook, Instagram, Twitter – all social media platforms can be an extra form of information for you. Scrolling through the comments and hashtags of a company or product can give you an idea of public opinion.

What is SWOT analysis?

SWOT analysis is a strategic process that defines the Strengths, Weaknesses, Opportunities, and Threats of a company, project, campaign, or organization. SWOT analysis aims to set objectives for your company and analyze your competitors.

SWOT analysis can be part of competitive intelligence when used as part of building out competitor company profiles. Here’s a template you can use during your CI analysis.

Importance of competitive intelligence: 7 key benefits

Competitive intelligence analysis is important as it eliminates guess work and informs strategic decision-makin based on the data.

If you’re not using competitive intelligence, you could be easily missing out on new information, market opportunities, potential mergers and acquisitions.

CI is valuable because using the results of analysis, your business can find the best ways to differentiate your campaigns, products, and learn from competitor performance.

Competitive intelligence is important because it offers great benefits including:

- Understand your market and industry

- Compare competitor performance

- Stay on top of market changes

- Keep your team informed

- Make your strategy stronger

- Identify competitor weaknesses

- Learn from competitor strengths

Knowledge is power. CI is the key to helping your company learn from your competitors, whether it be what they’re doing right or what they’ve done wrong.

Understand your market and industry

The market is constantly developing. Where does your company fit in, what can you offer and who are your industry leaders? Competitive intelligence offers important, valuable insight to guide the early steps of building out your business strategy and to help you understand what your company can best offer to fill in the market.

How is competitive intelligence applied in different industries?

Every industry uses competitive intelligence, but it doesn’t look exactly the same as every industry has its own unique challenges.

In the retail industry, competitive intelligence is applied to understand the pricing strategies of competitors. Retailers use tools like price tracking software to monitor the prices of similar products in the market. They analyze this data to adjust their own pricing strategies, ensuring they remain competitive. Additionally, they also study promotional strategies, product assortments, and customer service policies of competitors to identify areas of improvement.

In the finance industry, competitive intelligence is used to understand the investment strategies of other firms. Financial institutions monitor the investment patterns, asset allocations, and performance of their competitors. They use this information to refine their own investment strategies and to provide better services to their clients. They also study the regulatory changes and market trends to manage risks.

In the hospitality industry, competitive intelligence is used to improve the guest experience. Hotels monitor the services, amenities, pricing strategies, and customer reviews of their competitors. They analyze this data to identify the areas where they can improve their own guest experience. They also keep an eye on travel trends and consumer preferences to tailor their services.

Tools for competitive intelligence: how to get foot traffic data

Looking to start gathering competitive intelligence? CI can offer greater insights for industry benchmarking and tell you how well your competitors are performing compared to the wider market. This can better set expectations within your company.

You can compare competitors easily within Almanac – up to five at once. To compare competitor performance, log in to Almanac, click “Benchmarking Report” then select your competitors. Sign up now to begin competitive intelligence

Competitive intelligence FAQs

What is the first thing a company does when analyzing competitors?

The first step a company does to complete competitive analysis is identifying the competitors. Typically, the company will build a list of primary and secondary competitors using market research and data.

How do you find competitive information?

Find competitive information by acting as a customer: sign up for newsletters, follow social media pages, check the company website, and download the company app. Data services also provide competitive information such as foot traffic data, demographic information, and performance over time.

What is competitive intelligence in marketing?

Competitive intelligence (CI) in marketing is the process of gathering and analyzing information on competitors. In marketing, CI can provide further insights into campaign potential and inform your content marketing strategy.