Retail corridors are vibrant, concentrated areas home to a variety of businesses including shops and restaurants. These corridors form the backbone of urban commerce, providing a dense mix of offerings which can attract a wide range of consumers.

What makes retail corridors unique is their strategic location and accessibility. Corridors can often be found in bustling neighborhoods or along major thoroughfares where foot traffic is naturally high. Let’s see what makes retail corridors work and what retailers can learn from them.

Analyze retail corridors and locations. At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Book a call now.

Jump to:

Examples of retail corridors

Places like 13th Street/Midtown Village in Philadelphia, Arthur Avenue in the Bronx, and Boulevard Saint-Germain in Paris are all examples of retail corridors, integrating seamlessly into the urban fabric and contributing significantly to local economies.

These areas are not just about shopping; they are social, cultural, and economic hubs that offer opportunities for community interaction and local events. A well-managed retail corridor can boost tourism, create jobs, and enhance the overall vibrancy of a neighborhood.

How do retail corridors evolve over time?

Retail corridors inhabit the culture of their city, bringing shop, restaurants, and entertainment venues with a unique flavor. For example, 13th Street/Midtown in Philadelphia is known for its LBGT+ friendly nightclubs, along with its central location in the city. Arthur Avenue in the Bronx is at the heart of the Bronx’s “Little Italy”.

As the culture of a city expands, or new developments rise, retail corridors change with the times. This can mean new festivals to reflect on the city’s culture, new night clubs, bringing in coffee shop chains, and changes in brick-and-mortar stores.

Many retail corridors have existed for years with the Arthur Avenue Retail market having history all the way back to 1891.

Overtime, retail corridors have developed to keep up with the digital landscape. Retailers in corridors have banded together to make websites and social media profiles of their street or district area, keeping those within the trade area informed of any events and offers.

Read More: The Future of Shopping Malls

Retail corridor rent prices

The rent price and velocity of retail corridors varies on location, square footage, and other factors. Overall, velocity has decreased in some corridors since the pandemic with vacancy rates stabilizing.

One example of this is Manhattan, where in late 2023 and early 2024 there’s been some big leasing, selling, and buying moves.

In December, Prada made several major moves, including agreeing or about $6,500 per square foot also from Jeff Sutton’s Wharton Properties, at a price that was nearly double its last trade in 2012.

Looking at Manhattan further, the average asking rent in Manhattan’s retail corridors was $669 per sq. ft. —up 1% from the prior quarter and the sixth consecutive quarterly increase, according to CBRE Research report Manhattan Retail Figures Q4 2023.

What tools can be used to analyze the success of retail corridors?

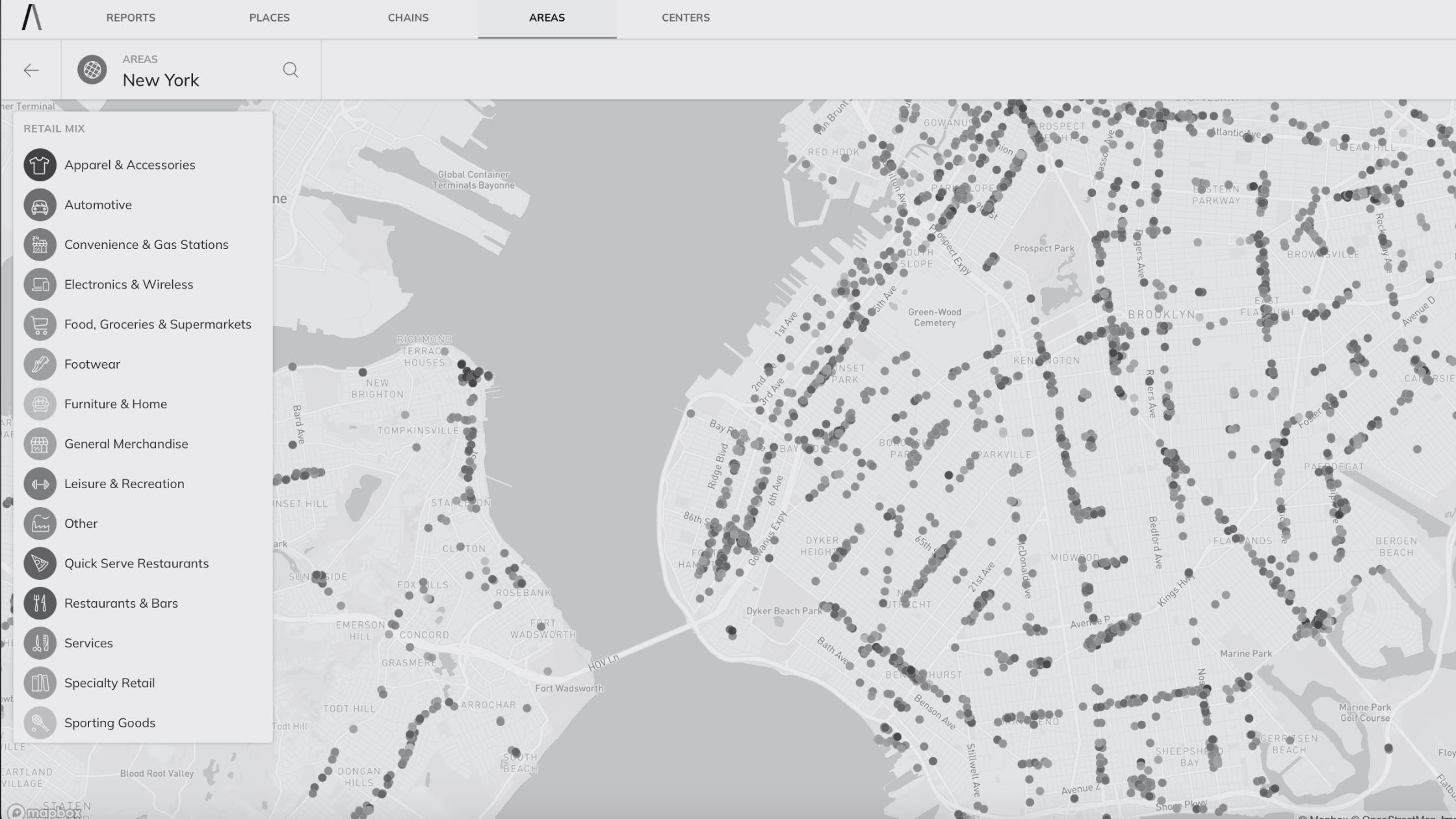

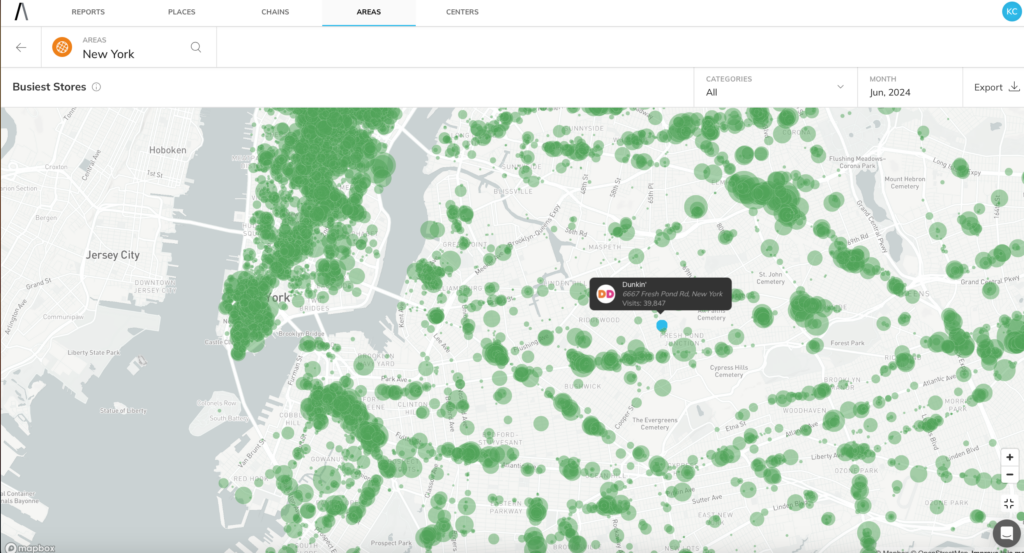

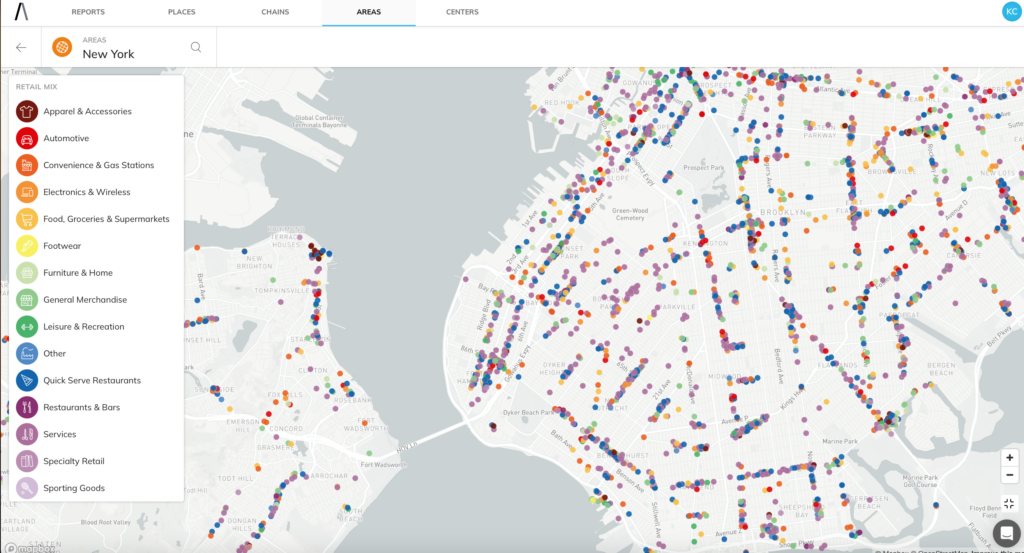

When analyzing a retail corridor, various tools and techniques come into play to offer a comprehensive view of its performance and potential.

1. Foot Traffic Analytics: Understanding the flow of people in and out of retail spaces is crucial. Tools and platforms from foot traffic data providers can highlight peak days, areas, and offer competitive intelligence on stores within the retail corridor.

2. Sales Data Analysis: Examining point-of-sale (POS) systems and financial reports helps measure the profitability of businesses within the corridor.

3. Demographic Studies: Data providers can offer aggregated information and deeper insights into the demographics of visitors and the surrounding community, such as age ranges, income levels, and education levels. This information helps tailor retail offerings to match the needs and preferences of local consumers.

4. Social Media Monitoring: Keeping an eye on social media chatter can reveal public sentiment and emerging trends. Tools like Hootsuite and Hubspot enable you to track mentions and analyze social media metrics about your profiles, helping to make customer segments for better performing marketing campaigns.

5. Customer Surveys: Direct feedback from shoppers through surveys can provide valuable qualitative data. Platforms like SurveyMonkey and Google Forms allow you to capture and analyze customer opinions and suggestions.

By utilizing these tools, you can gain a holistic view of a retail corridor’s health and uncover opportunities for growth and improvement.

Analyze retail corridors and locations. At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Book a call now.

What factors contribute to the success of a retail corridor?

Successful retail corridors are a dynamic blend of several essential factors. These factors include:

- Location

- Mixed-use developments

- Community engagement

- Tenant mix

- Effective urban design

- Marketing and branding

- Wider economic effects

Location

One major contributor is location. Proximity to major transportation hubs, such as highways or public transit, significantly boosts foot traffic and ease of access. Areas with high residential densities or tourist attractions nearby are naturally better positioned for success.

To analyze a retail corridor area’s success, retailers can use geospatial intelligence.

Mixed-use development

Mixed-use development is another key factor. Retail corridors that contain shops with commercial offices, residential units, and entertainment venues create a vibrant, round-the-clock destination.

This blend encourages more consistent visitation throughout the day and evening, rather than limiting activity to typical visiting hours. Retailers may be able to improve their success rate and longevity by including spaces of mixed-use, such as meeting areas for community groups and entertainment events like watch parties.

Community engagement

Another vital aspect is community engagement. Retail corridors thrive when they reflect and serve the needs and desires of the local community.

Regular community events, such as farmers markets, cultural festivals, or holiday celebrations, not only draw visitors but also foster a sense of belonging and loyalty among residents.

Community hubs take also be part of the retail mix of corridors, such as the LGBT+ community hub in Midtown, Philadelphia.

Tenant mix

High tenant mix diversity also plays a crucial role. A well-curated selection of retailers, ranging from big-name brands to niche local businesses, attracts a broader customer base. This mix ensures that different consumer needs and preferences are met, making the corridor a one-stop destination for shopping and dining.

Effective urban design

Effective urban design cannot be overlooked. Features such as wide, pedestrian-friendly sidewalks, ample lighting, aesthetic landscaping, and adequate seating areas contribute to a more inviting atmosphere. Safety and cleanliness also greatly influence public perception and customers’ willingness to visit and spend time in a retail corridor.

Marketing and branding

Lastly, robust marketing and branding strategies are indispensable. Retail corridors with a well-defined brand identity and effective promotional campaigns can draw interest from both locals and visitors. This is helped when your retail corridor has a strong sense of identity, such as Little Italy in the Bronx.

Regularly updated social media platforms, engaging websites, and advertisements can help maintain a high profile and communicate ongoing events and new arrivals efficiently.

Wider economic effects

It goes without saying that went the economy does well, retail does well. However, it’s more complicated than that.

Retail corridors, the bustling stretches where diverse shops and eateries converge, serve as the lifeblood of urban areas. These areas are marked by heavy foot traffic and robust commercial activity, creating dynamic environments that stimulate local economies.

When local economies benefit from a new company opening an office, an expansion, or having an influx of students, so do retail corridors. When the pandemic struck local economies, it hit retail corridors too.

What economic effects hit your retail corridor will depend on your location. While wide effecting events such as the pandemic make a large impact across the nation, small effects such as events also stimulate activity in corridors.

Festivals and events

Festivals and special events serve as a magnet, drawing crowds from neighboring areas and even those at a distance.

These occasions not only attract visitors but also create a sense of community, fostering local engagement and loyalty. Retailers often see a surge in sales during these times, as the festive atmosphere encourages spending.

Working together, businesses in a retail corridor can boost foot traffic to their area by hosting events.

Read more: How to Increase Foot Traffic

Key takeaways

- Retail corridors are at the heart of urban retail. Corridors can have a strong cultural identity, a long history, and impact on local economies.

- Retail corridors can change over time to reflect the local area’s identity, economic well-being, and from adapting to wider trends in retail.

- Retailers can use tools from data providers, accessing anonymized and aggregated data, to optimize performance.

Analyze retail corridors and locations. At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Book a call now.