Suburban retail, since 2020, has outperformed urban retail because of economic factors. What does the rise of suburban retail mean for the industry and will the trend flip once again in the future?

We take a look at everything from foot traffic, rent charges, effects Work From Home, and how retailers are responding.

Jump to:

What are the main differences between urban and suburban retail?

Over half of U.S. households describing their neighborhood as suburban. Suburban retail is located in residential areas outside of a central city. It is characterized by larger stores, ample parking, and sometimes, shopping malls.

The shopping experience in suburban areas is often more convenient for families and designed to cater to daily needs. In suburban retail areas, you typically encounter big-box stores and national chains that offer a wide range of products, from groceries to electronics.

Urban retail typically refers to the retail experience found in city centers or downtown areas. These locations are typically characterized by high foot traffic, a mix of retail and dining options, and often, limited parking spaces. You’ll find a variety of stores ranging from luxury boutiques to chain retailers, all within walking distance. Urban retail benefits from the concentration of businesses and residential units, which helps boost overall sales and market share.

Customers typically reach suburban retailers in their cars, resulting in a wider trade area whereas, urban retailers are reached through walking, cycling, public transit as well as some cars.

The movement to suburban areas

Van Nieuwerburgh, a professor of real estate and finance at Columbia Business School, writes, “Covid-induced migration patterns began to take on a more persistent character. Many households transitioned from temporarily renting a suburban home to purchasing a suburban home.”

This trend reflects a broader shift in how people are choosing to live and shop, with significant implications for retail. With an increasing number of individuals putting down permanent roots in suburban areas, suburban retail has experienced a resurgence.

Once limited to large malls and strip centers, suburban shopping now includes more mixed-use developments, combining retail, dining, and entertainment options.

Conversely, urban retail has had a difficult few years since 2019 to 2024. Shocked by the COVID pandemic and delayed by the rising cost of living, urban retail has struggled to gain a foothold.

Our recent analysis, for example, found that although Nike increased its foot traffic by 16% that didn’t reflect in sales!

2024 could bring an investor resurgence as consumer spending recovers and record-low retail vacancies in urban areas. This led to a combined 3.3% growth in asking rents in prime retail corridors from 2022 to 2023, according to JLL’s 2024 City Retail Report.

While retailers may have been looking at suburban areas with interest, particularly to help boost sales if urban stores were struggling, 2024 could bring a time of recovery if retailers play their cards right.

Hybrid and remote working

Office workers drive economic activity in urban areas. The rise of hybrid and remote work has shifted this dynamic. 40% of US employees now working remotely at least one day a week.

he shift from being in the office to staying at home means less purchases made in urban areas during office hours.

While the bustling energy of pre-pandemic downtowns showcased a myriad of retail opportunities, the new norm of hybrid work has resulted in a noticeable decline in foot traffic around office-heavy urban cores.

Yet, it’s not all gloom for urban areas. The New York Times analyzed 10 cities to uncover the American downtown. The NY Times stated, “While there’s no simple answer for why some places have rebounded while others limp along, their experiences reveal the challenges and possibilities that lie ahead for the country’s cities and towns.”

No answer to the question of “is suburban or urban areas better for retail?’, particularly in these volatile times, is simple. The trend of hybrid and remote working only complicates it for retailers.

To calculate whether an urban or suburban site would be beneficial for your retail business, a site selection process is more crucial than ever.

At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Book a call now.

What benefits do suburban retail locations offer?

Suburban retail locations offer a number of benefits that cater to a wide range of shoppers. Some of these benefits that bring in customers include:

- Parking: Unlike urban centers where parking can be a struggle, suburban malls and shopping areas usually come with large parking lots that make it easy for customers to find a spot without endless circling.

- Accessibility: Suburban areas tend to have clearer roadways and better traffic management, simplifying the driving experience. This can be especially beneficial for those who prefer to shop during peak hours. Suburban retailers typically have longer open hours than urban areas to catch families and commuters, so customers don’t have to rush.

- Community: Beyond convenience, suburban retail locations frequently cultivate a sense of community. Whether it’s through local farmers’ markets, family-centered events, or seasonal sales, these retail spots often become social hubs where you can connect with neighbors and partake in community activities. This fosters a welcoming atmosphere that extends beyond transactions.

- Family friendly: Play areas are common in suburban retail spaces as a higher number of families visit these areas than urban centers.

Are urban areas better for retailers?

Urban retail can boast a vibrant and dynamic atmosphere, driven by the constant foot traffic from diverse populations, while suburban retail tends to be more laid-back and with retailers widely spaced out. Key differences, such as store variety and customer demographics, shape the shopping journey in each setting uniquely.

Urban areas may be better for retailers in some circumstances such as businesses that can benefit from high foot traffic areas, visibility, and are prepared to face high rent costs.

Diverse and dense customer bases

They often attract a diverse and dense customer base, due to the concentration of residents, workers, and tourists. City centers used to be the powerhouses of retail, and there is now an opportunity to recapture that role. With the renewed interest in urban living, working, shopping, and dining, downtowns have the chance to regain market share and enhance the community’s quality of life.

Higher foot traffic

Retailers in urban areas can benefit from foot traffic, visibility, and the synergies of being near other established businesses. For instance, walkable urban retail is on the rise and tends to command rent premiums. High-profile shopping streets in cities like San Francisco, Chicago, and Santa Monica showcase clusters of the latest industry offerings, drawing shoppers with their variety and convenience.

Use competitive intelligence and site selection

Not all urban areas are born equal. It’s important to note that challenges like elevated retail vacancies still exist in prominent downtown locations and not all locations will be suitable for your business, regardless of the benefits they may offer on average for retailers.

Retailers need to adopt best business practices, such as carefully choosing locations with high visibility and proximity to other retail stores to maximize cross-shopping opportunities and using competitive intelligence to understand the competition you may have in urban areas.

By navigating these challenges and leveraging the inherent advantages of urban settings, retailers can potentially thrive in city environments.

Are suburban retail locations more family-friendly?

Yes and no! Suburban retailers, depending on location, may have more space to include play areas, family-friendly bathrooms and changing rooms, and other activities for families over the year.

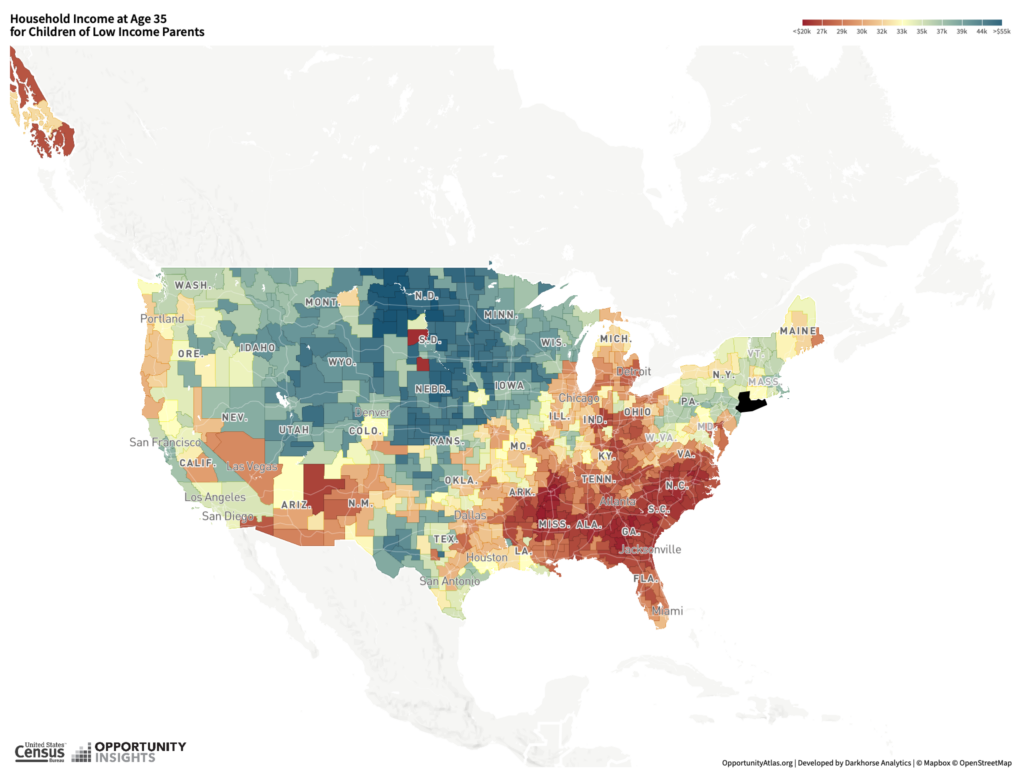

Where people choose to raise their family effects retailers. The discussion of where to raise a family has gotten so detailed, an online community atlas now maps what a child’s income could be when they’re older based on where they were raised.

When considering the dynamics of urban versus suburban retail, it’s essential to understand how community involvement shapes these locales. In urban areas, the density and diversity of the population often result in a vibrant, ever-changing retail environment. Here, retailers not only sell products but also become integral parts of the local culture, influencing and being influenced by the neighborhood they serve.

However, suburban settings offer ample space for retailers to create expansive stores and extensive parking lots, enhancing convenience for shoppers. Need diapers for your baby? Jump in the car, drive, and you’ve got what you need. In urban areas, this may be less convenient to achieve!

This is particularly suited for families who prioritize ease of access and ample amenities. Suburban retail environments are more likely to host community events, reinforcing their role as community hubs where shopping and socializing go hand in hand.

Ultimately, whether urban or suburban, each retail environment offers unique benefits and challenges, often dictated by the needs and behaviors of its community members. By understanding these differences, retailers can strategically position themselves to succeed in either setting.

Are there more seasonal sales in urban retail areas?

Urban retail area experience more seasonal sales, often making them into huge events, driven by their vibrant and dense communities. In bustling city centers, you’ll often find stores marking holidays with special promotions and creative window displays that attract shoppers.

Consider the iconic shopping streets in places like San Francisco or New York City—these locations frequently roll out the red carpet for seasonal events, ensuring a rich shopping experience.

Thanks to high foot traffic and more diverse populations, urban retailers can capitalize on every holiday and season. Events such as back-to-school, Halloween, Black Friday, and Christmas bring many customers eager to capitalize on limited-time offers. This boost from sales can make a big difference to smaller retailers, independent stores, pop-up shops, and can be a large driver of profits for big retailers too.

These areas can offer a unique blend of experiences, from pop-up markets to festive parades, which further drive retail sales surrounding major holidays. The dynamic environment of city life lends itself to spontaneous shopping sprees, which retailers can easily exploit with timely and enticing offers. As a result, the urban retail landscape pulses with energy during key shopping periods, making it an exciting and profitable time for business owners.

The concept of 15 minute cities

We can’t discuss urban retail without talking about 15 minute cities. These new developments and ways of thinking about city planning aim to have all essentials within a 15 minute journey from the home. This would put pharmacies, restaurants, parks, offices, retail and entertainment facilities within 15 minutes of homes.

This concept has gained attention in Europe with major cities such as Paris and Barcelona in the process of implementing this concept.

One city retailers should keep their eyes on is Bellevue in Washington state. Through its Environmental Stewardship Plan 2021–2025, the city aims to reduce commute times, carbon emssions and boost community through the 15 minute city planning.

How to decide if urban or suburban is better for your retail store

To see if urban or suburban is best for your business, you will need to complete a few steps of analysis:

- Benchmark: See how well your current store(s) are performing, compare with competitors, and set expectations.

- Foot traffic: Analyze competitor’s visitor numbers overtime and use our 90 day predictive feeds.

- Site selection: See where your business would best fit in locations across the USA.

Analyze a city’s retail mix, foot traffic and visitor demographics using pass_by. We offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Book a call now.