Predictive analytics is sometimes described as a crystal ball, as it can help you predict future events or trends. But predictive analytics is far from magic – it’s a real and reliable tool that’s transforming commercial real estate.

But, as these predictive insights are made using artificial intelligence (AI), it does need to be used properly and have accurate historical data to pull from.

What is predictive analytics in commercial real estate?

Predictive analytics in commercial real estate is a tool that uses historical and real-time data to create forecasts to predict trends, identify optimal investment opportunities, limit risks, and inform investors.

This type of analytics is used by realtors, investors, buyers, and sellers to predict future events and guide steps to the best outcome possible.

Generate predictive analytics by gathering data and finding patterns. In CRE, the best way to accomplish this is through AI.

AI-powered analytics is a sophisticated approach that factors in various data sources, foot traffic patterns, and can analyze years of data efficiently.

Our data offers enhanced predictive data. Our customers receive predictive data that has up to 90% accuracy compared to ground-truth verified data. Book a demo to see how it works.

How is predictive analytics used in real estate?

By 2025, the AI in real estate market is predicted to reach $8.9 Billion. Realtors are already using these analytics throughout their operations. Predictive analytics is used in real estate during acquisition, asset management, leasing, and tenant discovery.

- Price estimates: Create pricing estimates and predict return on investment (ROI).

- Buying and selling timing: Calculate the best time to purchase or sell a property based on market trends.

- Asset performance analysis: Evaluate and compare asset performance and adjust your investments accordingly.

- Foot traffic insights: Estimate the number of visits for the next 90 days with up to 90% accuracy.

- Demographic insights: Consider the visitors and locals near the location and analyze their behavior.

- Trade area analysis: Understand your location and visitors by creating a trade area analysis, using predictive analytics to evaluate growth opportunities.

To achieve accurate analysis, the real estate industry uses a wide array of data from property sales histories, years of foot traffic data, location data, competitor performance, and much more.

Examples of predictive analytics in commercial real estate

The use cases of predictive analytics are varied. The CRE industry has made good use of predictive tools and insights to improve investment strategies, streamline maintenance, adjust marketing efforts, create benchmark reports, and analyze trade areas. These are just a few examples of how you can use predictive analytics.

Predictive maintenance

Foot traffic sensors can be placed in strategic locations to record the number of visits, for example, the number of people using the elevator in an office on a daily basis or to predict areas that will soon require cleaning. This way of utilizing machine learning can improve resource allocation.

Profile and segment customers

77% of email ROI comes from segmented, targeted, and triggered campaigns. Targeted marketing campaigns are the key to achieving higher conversion rates. To do this, you will need to segment customers. Machine learning can be used during this process to sort the data and identify patterns.

Analyze site performance

How well can you expect your location to perform in the next few months? Monitor the performance of your centers, anchors, and identify opportunities using foot traffic data trends and predictive insights. Using these insights, you can spot visitor patterns, understand trends, and anticipate a rise or fall in profit.

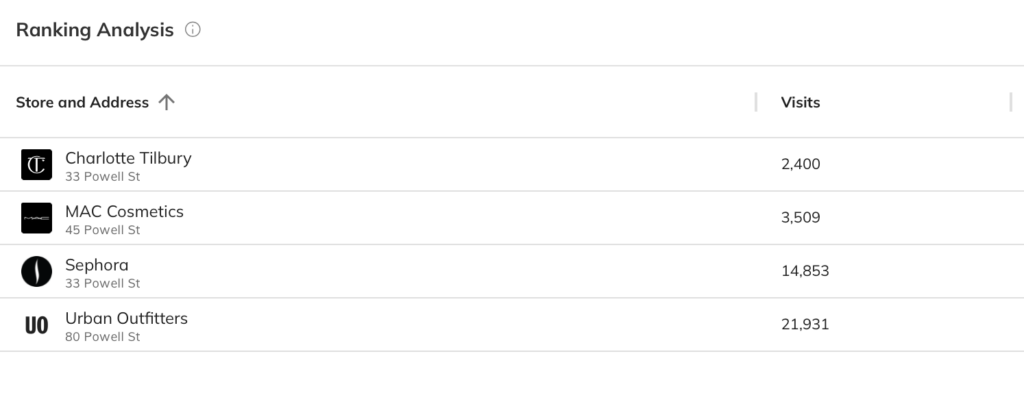

To analyze site performance, you can compare your location against its competitors in its primary trade area.

Our ranking analysis and benchmarking reports pull from four years of foot traffic historical data to visualize key information you need to know.

Inform your decision-making with data that has a 94% correlation to ground truth. Speak to our team now for a demo and begin analyzing site performance.

Benefits of predictive analytics in CRE

The real estate industry has seen many challenges in recent years. New technologies have brought with them a wave of transformation, enabling data-driven decision-making to overcome these challenges. Let’s look at some of the advantages.

1. Enhanced decision-making

Predictive analytics uses vast amounts of data to offer precise insights, enabling investors and real estate professionals to make informed decisions. Be it determining the most profitable investments, gauging the risks involved, or setting optimal rental prices, predictive analytics elevates the accuracy of your decisions, reducing guesswork and costly errors.

2. Boosted efficiency

Predictive analytics can assist in identifying optimal times for maintenance and repairs, which can lead to more efficient use of resources. Predicting and scheduling repairs before an issue arises eliminates potential downtime, optimizes energy usage, and reduces maintenance costs, thereby enhancing operational efficiency.

3. Optimized property value

Accurately evaluating a property’s value is crucial in commercial real estate. Predictive analytics can accurately estimate rental values, expenditures necessary for improvements, and market trends, ultimately maximizing your Return on Investment (ROI).

4. Improved marketing

Predictive analytics also plays a pivotal role in improving marketing strategies by profiling and segmenting customers. By understanding customer preferences and behavior patterns, you can personalize your services, offer properties that cater to their specific needs, and ultimately increase their satisfaction and likelihood of securing deals.

Predictive analytics is a powerful tool to identify, monitor, and analyze commercial real estate. By using this tool, real estate agents and investors alike can get insights into the future to guide decision-making.

AI predictive analytics for real estate challenges & how to overcome them

Using new technologies always comes with some challenges, but the benefits of predictive analytics makes the challenges worth it. Let’s look at these challenges and how best to overcome them so you can have the best analytics possible.

1. Slow implementation

While many in real estate are using predictive tools, many aren’t. Due to the recentness of this new technology, some are reluctant to be trendsetters and are content to wait for others to test out these avenues. However, this can lead to competitors pulling ahead as they will be benefitting from predictive insights while you fall behind.

A lack of training can also cause issues. To avoid this, it’s best to work with a data provider and reach out to their team with any questions during implementation.

2. Inaccurate data

It’s an unfortunate truth that some foot traffic and location data providers by inaccurate data from relying on GPS signals from mobile phones, which not every visitor to the location will enable. To ensure your predictive analytics is reliable, using reliable data is a necessity.

Always book a demo, see the data platform, and ask where the data is coming from and its accuracy rate compared to ground-truth. Our data has a 94% correlation to ground truth verified data – any less than this shouldn’t be considered.

3. Privacy concerns

While data is needed to complete an analysis, it needs to be anonymized and aggregated to comply with the law and avoid invading privacy. Our datasets are meticulously cleaned, validated, and privacy-compliant, ensuring the highest level of accuracy and reliability.

Where to find AI-powered predictive analytics

Predictive analytics is an emerging technology that commercial real estate can greatly benefit from, but caution needs to be applied to ensure you get the best insights. The market is full of companies offering predictive analytics, but few offer insights based on ground-truth verified data you can rely on.

For those ready to embrace predictive data, our solutions can help. Book a demo with our team to see how it works.