As the 2024 calendar year comes to an end and 2025 kicks off, pass_by is looking at the top brands to add to your radar this year. 2025 is set to be full of surprises from big retailers closing stores to competitors emerging from the shadow of legacy names.

The hottest retailers to watch in 2025 are:

- Bath & Body Works

- Nordstrom

- Lululemon Athletica

- Build A Bear Workshop

- Macy’s

- Sur La Table

- Pottery Barn

- Bob’s Discount Furniture

- Balenciaga

- Tiffany & co

- Goodwill Industries

- Sézane

At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Sign up to our newsletter so you never miss a report.

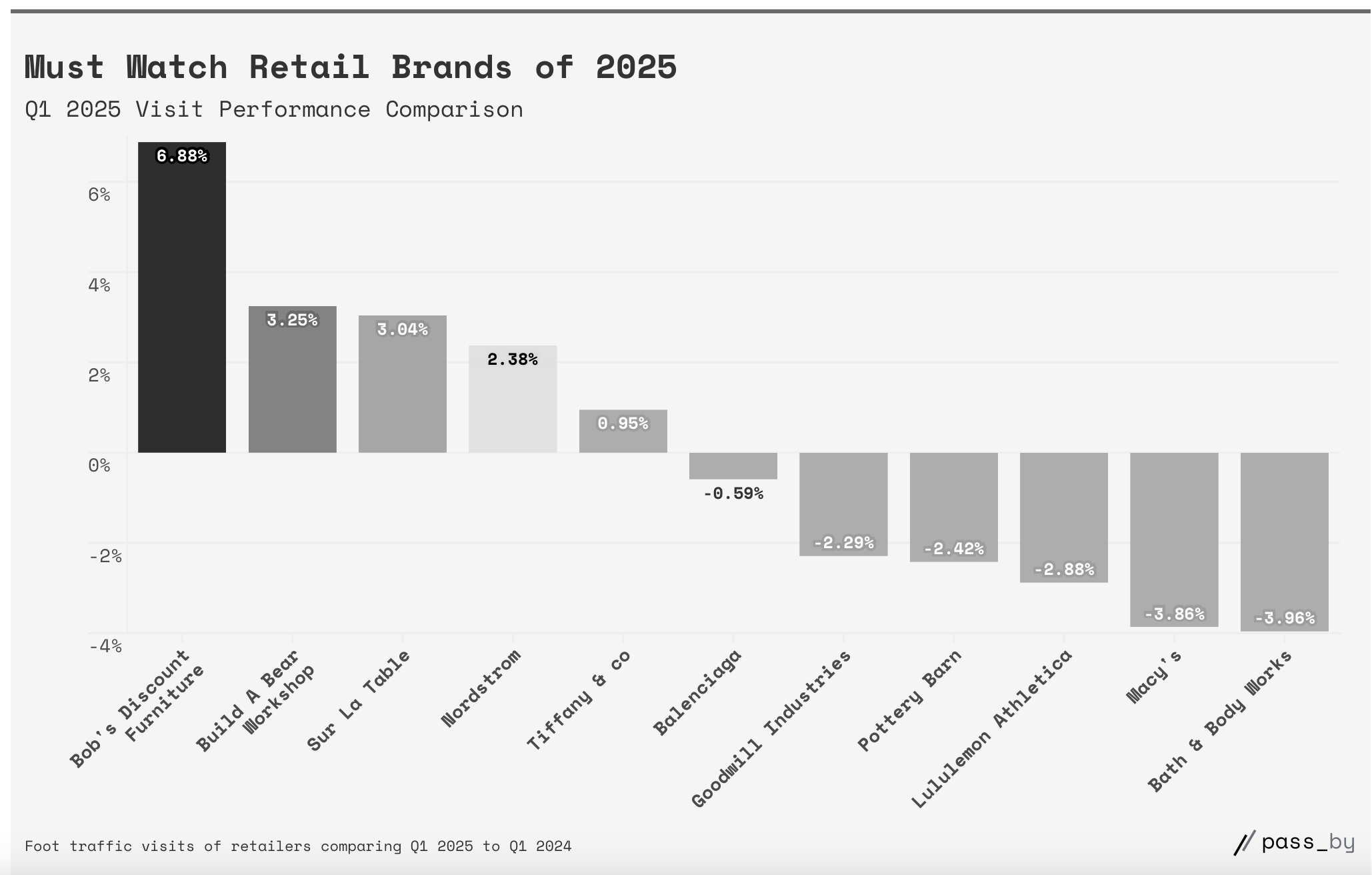

Must Watch Retail Brands Q1 2025 Visit Performance Comparison

1. Beauty retailer to watch: Bath & Body Works

- Stores: 1,850+ in U.S & Canada

- Industries: Specialty Retail; home fragrances, candles, gifts and bath & body products.

- Size: 57,200+ employees

- Revenue: $7.429 Billion in 2024

Recently making headlines for its new Gingham+ store design, Bath & Body Works is set to roll out its new store layouts to the majority of its U.S stores in 2025–aimed at making the shopping experience more tailored to the tastes of its growing Generation Z customer base.

Bath & Body Works is a great retailer to watch in 2025 to see how this brand is capturing the interest & foot traffic visits of a younger customer demographic.

The retailer is also working on its location strategy. While Bath & Body Works has always been more of an off-mall brand, 2024 displayed that even further as the retailer opened 106 stores in North America (almost all of which were outside malls) while closing 61 of its stores, the majority of which were inside malls. In 2025, we’ll see how this strategy plays out.

In terms of foot traffic visits, Bath & Body Works wasn’t the only beauty brand to see a dip in visits over the holidays. For December 2024, many beauty brands saw a drop in visits compared to 2023. Out of major competitors like Lush, Sephora, and ULTA Beauty, Bath & Body Works saw the smallest drop in visits at -7.72%.

Read more: Top 9 Retail industry Trends in 2025: What to Expect

2. Clothing retailer to watch: Nordstrom

- Stores: 95+

- Industries: Apparel & Accessories

- Size: 54,000+

- Revenue: $15.11 Billion USD in 2024

In December 2024, the retailer announced Nordstrom is going private in an all-cash transaction with an enterprise value of about $6.25 billion.

Nordstrom’s race against Macy’s has been neck and neck in the past few quarters in terms of visits to stores. In Q1 of 2025, Norstrom saw an increase in visits of +7.69% while Macy’s was close by at +7.04%. A similar story can be seen in Q4 2024 with Macy’s seeing a drop in visits of -3.86% and Nordstrom having a drop of -3.08%.

While both seeing drops in visits in Q4 2024 isn’t good news for either brand, it is the least bad outcome compared to other retailers in the space; Sock’s Fifth Avenue saw a drop of -8.11% in Q4 2024.

Nordstrom is an interesting one to watch to see how this competition with Macy’s plays out in 2025 and if its other competitors can turn around its downturn in foot traffic.

3. Sports wear retailer to watch: Lululemon Athletica

- Stores: 395+

- Industries: Apparel & Accessories; Sports wear

- Size: 38,000+ employees

- Revenue: $10.182 billion in 2024

Named as one of NRF’s Fastest Growing Retailers in 2023, Lululemon is on our radar once more. Lululemon entered 2024 strong with visits up by +36.82% in Q1 compared to Q1 2023.

Compared to competitor sportswear brands, Lululemon has seen consistent growth in visits in every quarter while some brands, like Nike and Adidas, have been more volitile. Only Lululemon athletica (1.15%) and New Balance (+4%) have seen visitor growth compared to last year going into Q1 2024.

All eyes are on lululemon’s upcoming fiscal earnings call set for March 27th.

4. Toy store to watch: Build A Bear Workshop

- Stores: 318+

- Industries: Toy store

- Size: 3,700+

- Revenue: $496.0 million in 2024

Q4 2024 was a successful period for Build A Bear Workshop +2.67% with November being a stand out month–the brand saw visits increase by +10.94%. Meanwhile Disney Store saw a drop of -4.84% in Q4 2024 and a drop in visits in Nveomber of -3.22%.

This aligns with Build A Bear Workshop’s record-breaking fiscal report reported Q4 2024 was highly successful: “excluding the extra week of operations in the fourth quarter of 2023, revenues increased 5.7%, and pre-tax income increased 15.8%”.

Build A Bear Workshop plans to open at least 50 new units in 2025. Keen-eyed followers should watch how the brand manages new store openings as costs rise from tariffs, and rising medical and labor costs.

5. Department store to watch: Macy’s

- Stores: 508+

- Industries: Department retailer; Apparel & Accessories, Homeware

- Size: 85,000+ employees

- Revenue: $7.77 billion in 2024

Macy’s, Inc. reported fourth quarter comparable sales down 1.1% on an owned basis; but the retailer did achieve its best owned-plus-licensed-plus-marketplace comparable sales since the first quarter of 2022, up 0.2%.

Macy’s and many of its competitors are struggling to bring in the same crowds as 2023 and have seena. Drop in foot traffic in Q4 2024. Macy’s saw a drop of -3.86%, which is less than other chains such as Kohl’s which saw a drop of -8.28%.

6. Kitchenware retailer to watch: Sur La Table

- Stores: 47+

- Industries: Homeware; kitchenware, dinnerware

- Size: 1,400+ employees

Sur La Table filed for bankruptcy at the height of the COVID-19 pandemic in 2020. At the time of its bankruptcy filing, Sur La Table said it had $230 million of in-store revenue, and $80 million in annual e-commerce revenue.

But online sales weren’t enough to cover the $4 million monthly rental bill of all Sur La Table’s stores while the chains had to close during lockdown.

Since then, Sur La Table had an increase in visits of +1.96% in Q4 2024 while Le Le Creuset experienced a decrease in visits of -7.09%. Williams-Sonoma has had higher visit growth in some quarters and a much larger number of visitors overall, but Sur La Table’s revival is noticeable since the pandmic. This retailer is one to watch to see how a retailer can recover.

7. Upscale furniture retailer to watch: Pottery Barn

- Stores: 170+

- Industries: Homeware; Furniture

- Size: 10,001+ employees

- Revenue: $3.2 billion in 2023

Many upscale furniture retailers have seen a decrease in visits in the past few quarters. Pottery Barn’s best quarter in the past year was Q2 2024 with a decrease of -0.08% in foot traffic, while at its lowest the retailer saw visits drop by -25.71% in Q1 2024 compared to 2023.

This isn’t unique to the brand, though. Pottery Barn’s upscale furniture competitors have also been struggling to bring in similar numbers compared to 2023 and the retailer has performed better overall compared to the likes of Create & Barrel, Restoration Hardware, Anthropologie, and West Elm.

8. Discount furniture retailer to watch: Bob’s Discount Furniture

- Stores: 190+

- Industries: Homeware; Furniture

- Size: 5,000+

- Revenue: $2.125 billion in 2022

In the last few quarters, Bob’s Discount Furniture hasn’t had discounted foot traffic! The retailer has seen a steady number of visitors compared to 2023 with only a decrease of -0.14% in Q4 2024.

While staying steady isn’t ideal compared to growth, it is a better picture compared to many of its competitors such as the American Furniture Warehouse which saw a decrease in visits of -5.48% in Q4 2024.

Visits did pick up in January 2025 by +2.39% for Bob’s Discount Furniture, even as big names like IKEA saw a drop in visitds by over 3%.

While more consumers are turning to e-commerce for furniture orders, many still prefer to go and see the furniture in person before buying; Bob’s Discount Furniture foot traffic numbers display how discount prices and a reason to visit brick-and-mortar keeps customers coming in.

9. Luxury retailer to watch: Balenciaga

- Stores: 40+

- Industries: Luxury retail

- Size: 1,001-5,000 employees

- Revenue: €1.1 billion Korig Group net profit in 2024

Favoured by big names from Kim Kardashian to Lindsay Lohan, luxury retailer Balenciaga has also caught headlines in 2025 for its version of luxury everyday items, including hair clips.

But does it translate into visits? Balenciaga has seen some success in recent months with December being a stand out month, showing increases in visits of over +17% in 2024 compared to 2023. But visits dropped in February by over -11% compared to the previous year.

Still, compared to its competitors Balenciaga appears more stable in terms of visits. While visits did drop in February by over -11%, Gucci saw visits drop by over -20% and Chanel saw a decrease of -16.39%.

We’ll be watching Balenciaga to see if the retailer can find the luxury of consistency or if strong highs and some lows are simply the pattern of luxury retailers in today’s climate.

10. Jewelry retailer to watch: Tiffany & co

- Stores: 90+

- Industries: Accessories; Jewelry

- Size: 16,000+ employees

Tiffany’s is a huge brand name. But there’s no doubt that Tiffany & co has seen some struggles in the last few years, with the most recent quarter being no exception. Visits to Tiffany & co stores dropped by -49.65% from Q4 2024 to Q1 2025. While visits typically from from Q4 to Q1, this is the largest drop the brand has seen since the height of the pandemic.

Notably, visits to Tiffany & co stores dropped by -24.49% during the week of Valentine’s in 2025. Even with the boost of Valentine’s Day falling on a Friday, Tiffany’s struggled to see the benefits.

All eyes are on Tiffany’s & co to see what steps the retailer will take to recover visits in 2025.

At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Sign up to our newsletter so you never miss a report.

11. Second hand retailer to watch: Goodwill Industries

- Stores: 4,300+

- Industries: Second hand goods; Furniture, Homeware, Books, Apparel & Accessories, etc.

- Size: 105,000+ employees

- Revenue: $8.2 billion in 2024

Buying second-hand goods is a trend on everyone’s watch list as consumers turn to discount prices to help ease the pinch of rising costs.

In 2024, Goodwill only saw an increase in foot traffic of over 1% in Q2. Does this mean consumers are no longer seeking second hand goods? Not necessarily.

Goodwill did see increases in 2023 of +2.75% in Q1 2023 and unlike other retailers hasn’t seen dramatic, volitile patterns even compared The Salvation Army which has seen decreases in foot traffic of over -5.26% in Q4 2024 compared to -0.53% for Goodwill in the same quarter.

Those with keen eyes may seek to watch Goodwill to see how consumers react to economic changes since visits have remained mostly steady since 2023, any large increase or decrease could reveal a shift in consumer attitudes.

12. Retail pop-up to watch: Sézane

- Stores: 3 U.S stores

- Industries: Apparel & Accessories

- Size: 800+ employees (global)

Sézane is a French clothing retailer currently with three stores in the U.S it calls L’appartement. The retailer has also been experimenting with pop-up store locations in Washington DC, Austin, and San Jose.

Sézane is a B-Corp-certified company which generates over 80% of its sales online. When Sézane had its first funding round in 2021, first funding round, Téthys Invest bought its stake in the retailer, it was reported the label’s revenue in fiscal 2021 was €250 million. While Sézane hasn’t publicly disclosed revenue for years, the label claims to have been growing since.

Regardless, this brand is one to watch to see if a growing brand can make use of pop-up stores to gain traction.

How we’re keeping an eye on the retail scene

Watching what’s happening in the retail industry is great for understanding what your brand and stores can do (and what not to do!). We use over five years of historical visitation data and predictive analytics with the highest in market accuracy – that’s 94% correlation to ground truth. To keep a keen eye on the retail industry, contact us now.

FAQs

Who is the number 1 online retailer?

As of 2024, Amazon is the most popular online retailer with over $150 billion in net e-commerce sales, followed by JD, Walmart, Apple, and Shein.

Is Amazon bigger than Walmart?

In 2024, Amazon had almost double the amount in net e-commerce sales compared to Walmart. However, Walmart dominated in-person sales in the U.S.

What is the most valuable retail brand in the world?

As of 2024, Amazon was the most valuable retail brand in the world with a value of around $185 billion. Alibaba, Home Depot, and Walmart were the next most valuable retail brands in the world in 2024.

What is America’s fastest growing retailer?

The fatest retailer in America varies on the year as businesses adjust strategies for sustainable growth. In 2023, Chedraui experienced 137% growth thanks largely to its acquisition of Smart & Final stores, according to NRF Contributor Sandy Smith. In 2024, Cava, a Mediterranean fast-casual chain went public through an IPO 10 months ago, raising nearly $318 million.