In the evolving landscape of finance and investment, the quest for an edge over the competition is relentless. Traditional data sources, while still vital, are no longer enough. But what exactly is alternative data, and why has it become such a buzzword in the financial world? In essence, alternative data refers to non-traditional data sources that can provide unique insights and a competitive advantage.

This article gives you an overview of alternative data, how it’s utilized in finance, particularly by hedge funds, and touches upon the diverse types and examples of alt data available today. Whether you’re an investor, financial analyst, or just curious about the intricacies of modern finance, understanding alternative data can open new doors for smarter decision-making.

At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Book a call now.

Here’s everything you need to know about alternative data:

What is alternative data?

Alternative data is data from non-traditional sources, such as foot traffic data, social media engagement, and card transactions.

This data is then used to gain further insights to inform the investing process.

Alternative data, also shortened to alt data, is used by investors, hedge fund managers, and other professionals in the finance industry. The alternative data market is projected to reach $11.1 billion by 2026.

Alt data in finance

In finance, alternative data has emerged as a powerful tool that goes beyond traditional investment tools, such as quarterly reports. Alt data can provide a real-time lens into various aspects of market activity and company performance.

Most managers who are users of alternative data expect alt data to be widely used in the industry by 2025, according to the Alternative Investment Management Association (AIMA).

The days of assessing whether or not to invest based on earning announcements are long gone. Now, finance professionals can analyze foot traffic visits to stores, social media sentiment about its products, or satellite images of its manufacturing facilities. That’s the power of alternative data.

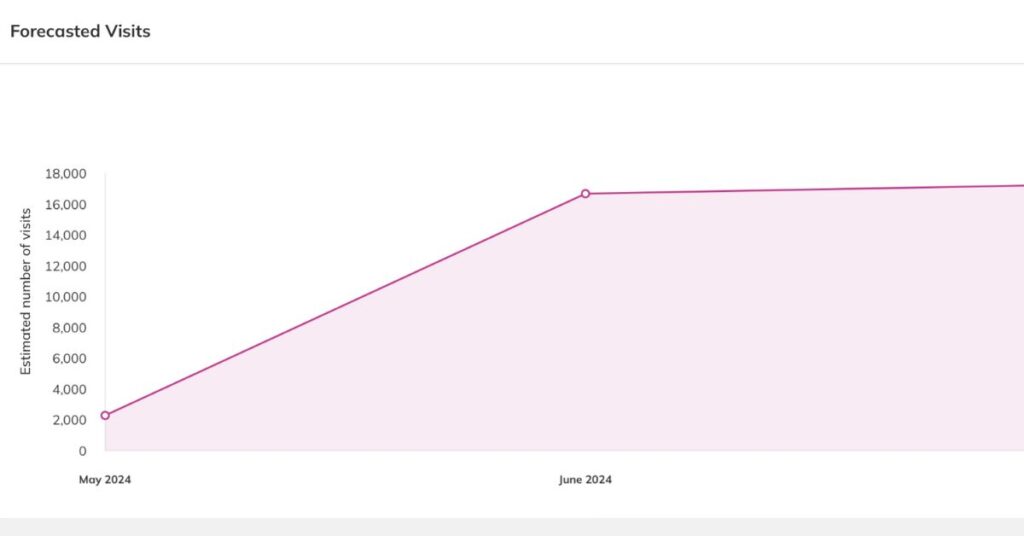

For example, investors can use predictive insights to gain insights on a company’s positive or negative trajectory. pass_by offers 90-days of predictive insights with up to 90% accuracy.

Alt data for hedge funds

Alt data for hedge funds goes beyond the usual boundaries of traditional data like financial statements, which everyone has access to. Using alt data sets can offer insights and predictions before your competitors get them, giving you an edge.

By tapping into sources beyond traditional financial statements, hedge funds can refine their models for better market predictions.

Hedge funds were arguably the first and most enthusiastic adopters of alt data. In a survey by Lowenstein Sandler, 65 percent of hedge funds say they use alternative data.

“Hedge funds and other investment advisers clearly continue to view alt data as meaningful when making investment decisions, and regulators are poised to continue their enforcement focus on the potential misuse of material nonpublic information and other risks posed by alt data.”

–Scott H. Moss, Partner & Chair, Fund Regulatory & Compliance, Lowenstein Sandler LLP.

Alt data examples

Alternative data comes in many, and its applications are vast and varied in the financial world. Types of alt data include:

- Web scraping

- Credit card transactions

- Mobile app usage

- Weather data

- Satellite imagery

- Flight tracking

- Sentiment analysis

- AI-powered predictive insights

Web scraping

Web scraping involves extracting large amounts of information from websites. This data can include product prices, consumer reviews, and even job postings. For finance professionals, such data can provide insights into market trends, consumer behavior, and economic activity at a granular level.

Credit card transactions

Aggregated and anonymized credit card transaction data offers a real-time look into consumer spending habits. This data helps analysts track industry performance, forecast the earnings of retail companies, and assess the impact of economic policies on consumer behavior.

Mobile app usage

Mobile app usage data reveals insights about consumer preferences and behaviors. For example, increased usage of food delivery apps might indicate a trend that could affect restaurant stocks. Similarly, a surge in downloads of a fitness app could suggest a rising interest in the health and wellness sectors.

Weather data

Weather data might not seem immediately relevant to finance, but it can be incredibly influential. For instance, hedge funds might use weather forecasts to predict agricultural yields and their subsequent impact on commodity prices. Similarly, retail businesses could adjust their inventory based on seasonal weather patterns.

Satellite imagery

Hedge funds often use alt data to predict industry trends and spot investment opportunities before they appear on the radar of mainstream investors.

For example, data from satellite imagery might show that a company’s factory is unusually quiet, signaling potential operational issues before any official announcements are made.

This data plays an important role in decision-making. Analytics and other data products from satellite imagery are projected to be a $2.2 billion annual business by the end of the decade, according to NSR’s Big Data Analytics Via Satellite annual report.

Flight tracking

One fascinating use case is tracking private jet flights, like those monitored by Quandl. This kind of data can alert hedge funds to executive meetings or high-level negotiations, offering invaluable insights into potential mergers, acquisitions, or business expansions.

Sentiment analysis

Another key application is sentiment analysis. By analyzing social media and web traffic, hedge funds can gauge public opinion about a company or product in real-time.

This sentiment can be a leading indicator of stock price movements, allowing funds to make informed decisions faster than the competition.

A study on stock price predictions using sentiment analysis predicted Apple stock with 75.38% accuracy. Though researchers suggested that the sentiment analysis performed better over a longer-term versus a shorter-term.

AI-powered predictive insights

By leveraging Artificial Intelligence (AI), financial analysts and hedge fund managers can identify patterns and trends that human eyes might overlook.

85% of asset managers are currently using AI to inform their investing decisions – why are asset managers so keen to use this new technology and should you follow suit? In short, Ai-powered insights enable more accurate predictions of market movements, company performance, and economic indicators.

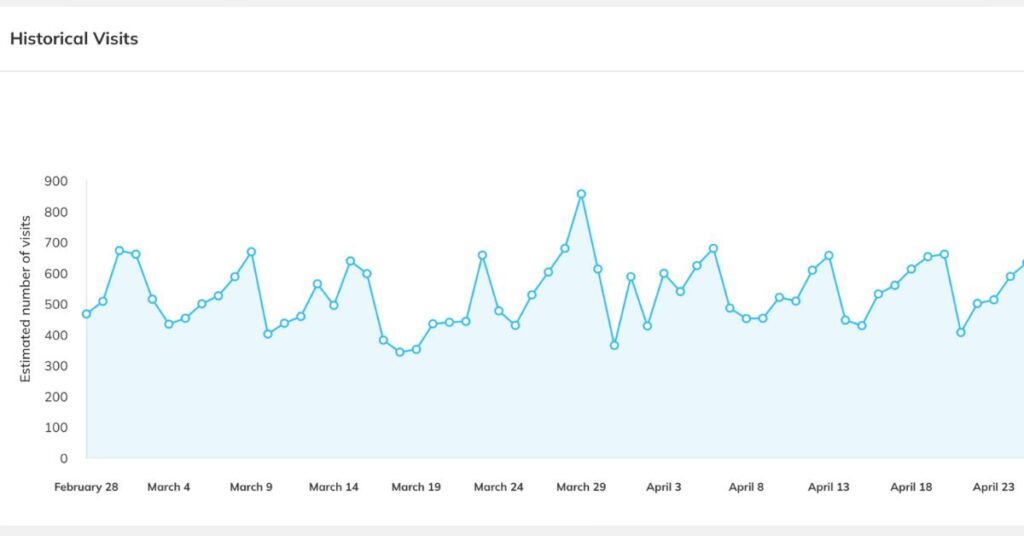

For instance, AI can process years of historical data to predict the next 90 days of visits to a retail location. Our predictive insights have up to 90% accuracy.

Additionally, AI’s real-time analysis offers a considerable edge. As markets move rapidly, having immediate access toactionable insights can mean the difference between capitalizing on an opportunity and missing it entirely. Hedge funds use these real-time insights to fine-tune their strategies on the fly, adapting to market conditions swiftly and effectively.

Ultimately, by integrating diverse alt data streams into their analytical frameworks, hedge funds, investors, and asset managers become more adept at navigating market volatility and uncovering hidden opportunities. This multi-faceted approach allows them to maintain a strategic edge in an increasingly data-driven financial landscape.

Benefits of alt data

Traditional data alone can lack immediacy and further context. Alternative data works alongside traditional data, not entirely replacing it, but adding insights and context to guide decision making. Through alt data, investors can find hidden trends, use predictive insights, and be confident in investment choices.

Alternative data offers a multitude of advantages that can significantly enhance financial analysis and decision-making processes including:

Immediacy: Traditional data sources such as quarterly reports can lag behind real-time information. Alt data can offer insights into the daily, monthly, and yearly situation of a business to create a clearer picture.

Frequency: Unlike conventional quarterly reports, alternative data can be updated more frequently. This continuous stream of information allows for dynamic analysis and more timely adjustments in strategy. For example, we have 15 data inputs and over 6 billion daily processed data points.

Context: Alternative data adds layers of context to traditional financial metrics. For example, credit card transaction data can provide insights into consumer behavior well before earnings reports are published.

By incorporating alternative data, financial analysts and hedge funds can gain a more comprehensive view of the market. This enhanced perspective allows for better risk management, more accurate forecasting, and ultimately, improved investment performance.

Challenges of using alternative data

While alternative data offers numerous benefits, it also brings its own set of challenges. Below are some of these challenges and how to overcome them.

Privacy concerns

Alternative data can pose privacy concerns. Personal information derived from sources like social media or mobile app usage must be handled with care to prevent breaches of privacy laws and to protect individual rights.

Solution: Seek an alt data provider that has anonymized and aggregated data, complies with data protection laws, and puts privacy first.

Endless choice

Alt data comes in many shapes and sizes. One of the major challenges investors face is seiving through the mass of alt data providers to find accurate and actionable data sets.

In a 2023 report, Deloitte found that the number of alternative data sets applicable to financial services increased by about 36% over the past two years, while the number of alternative data providers increased by about 30% over the same period.

Solution: Quality over quantity. It’s easy to get lost in the noise of alt data. Set out clear goals of what you want the data to do and let that guide you. If you want predictive insights on a business’s market performance, few datasets can compete with foot traffic. If you want to understand consumers, then look for demographic and psychographic datasets.

Interpretation and interpretation

Extracting actionable insights from alternative data requires sophisticated analytical tools and skilled analysts. The ability to correctly interpret the data correlates directly with the value it can provide.

Integrating alternative data into existing systems can also be complex. Many firms may lack the infrastructure to efficiently handle and process large volumes of diverse data sets. Developing or acquiring the necessary technology and expertise can be both time-consuming and costly.

Solution: Making sure you can gain actionable insights and interpret the data is essential. To do this, firms need to look for alt data providers with a suitable platform or tool. Asking for a demo is the fastest way to analyze whether it’s the type of tool you need.

Where to get alt data

Finding reliable sources for alternative data can be critical for your investment strategy or business decision-making process. There are several go-to places where you can obtain high-quality alternative data, such as specialized data providers.

Data provider platforms aggregate data from various sources making it accessible all in one place.

At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Book a call now.