The top “Big 4” grocery store giants in the U.S are Walmart, Albertsons Companies, Kroger and Costco. Walmart is the supermarket chain market leader with over 4,600 stores in the United States, Albertsons Companies operates under many banners such as Safeway and Vons, while Costco has a unique membership-based bulk buy model.

But how are these big supermarket chains performing? Are consumers still heading to grocery stores or has wider economic trends led to a decrease in visits? We explore how these supermarkets are performing in the U.S, retailer’s best months, and what this means for retail trends.

pass_by offers the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. To complete your analysis, book a demo.

Q1 2025 foot traffic performance

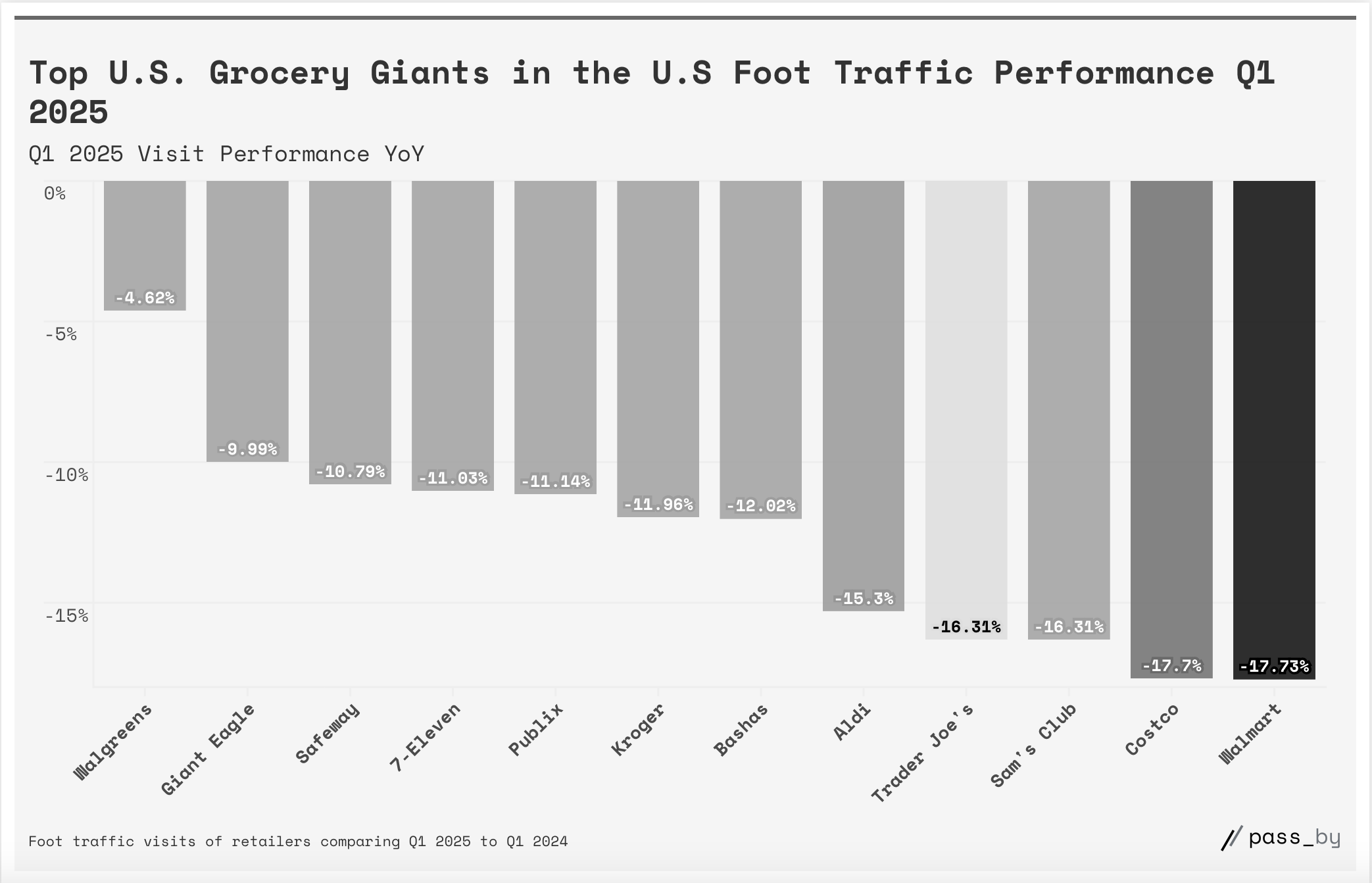

In Q4 2024, grocers saw an uptick in traffic (Costco +7.37%, Walmart +5.95%) however this increase in visits hasn’t continued into Q1 2025. Instead, consumers visited less often compared to the same period the year before due to various factors: saving after the holidays, wider economic uncertainity, election results, inflation, etc.

Our data shows a trend in Q1 2025 in consumer behaviour of shoppers reducing their visits to grocery stores, but visits did begin to uptick in March. While many retailers saw a large dip year-on-year in Q1 2025, 2024 was overall a good year for many supermarket chains.

pass_by offers the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. To complete your analysis, book a demo.

Top grocery store chains in the U.S

Navigating through the sea of grocery chains in the U.S can be quite an adventure, given the sheer size and diversity of the market! The U.S grocery market is not only a cornerstone of daily life but also a massive industry.

It’s essential to recognize the different types of grocery chains, from typical supermarkets like Kroger to discount grocers like Aldi and warehouse clubs such as Costco. Each offers distinct shopping experiences designed to cater to a wide array of consumer preferences and needs.

The top grocery store chains in the U.S are:

- Walmart

- Costco

- Bashas

- ALDI

- Trader Joe’s

- 7-Eleven

- Safeway

- Kroger

- Publix

- Giant Eagle

- Sam’s Club

- Walgreens

pass_by offers the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. To complete your analysis, book a demo.

1. Walmart

- Annual revenue: $648.125B (2024)

- Number of stores: over 4,600 stores in the U.S

- Size: 2,100,000 employees (2025)

Walmart is known for being one of the biggest supermarket chains in the world. Walmart is also the parent company of Sam’s Club.

Walmart foot traffic performance

Walmart did see an increase in visits in Q4 2024 of over 5%, but the visit growth didn’t continue into Q1 2025. Walmart had a tough time bringing in visitors in the first quarter as visits fell by over 17% which was one of the biggest decreases in foot traffic visits going into 2025, however, this isn’t unique to Walmart. Many of its competitors experienced the same shift in consumer behaviour.

Despite more volatile foot traffic, Walmart is still the biggest supermarket in the U.S and not only from its sheer number of stores (over 4,600!) but in terms of its gross profit. In 2024, the grocery giant reported $157.98 Billion in gross profit.

Walmart also benefitted during Amazon Prime Day in July 2025 where the grocer saw an uptick of +7.65% in footfall.

Walmart’s best month in in 2024 was December when the hypermarket chain saw over one billion visitors as consumers rushed to the store for all their holiday needs. Few retailers can compete with these numbers!

2. Costco

- Annual revenue: $249.6 billion (2024)

- Number of stores: over 610 stores in the U.S

- Size: over 210,000 employees in the U.S (2025)

Costco is known for its membership-scheme and warehouse-style supermarket stores which sell bulk grocery items at discounted prices.

Costco foot traffic performance

Costco experienced an increase, like many supermarkets, in Q4 2024 as visits increased across November and December compared to the previous year. Going into Q1 2025, many supermarkets also saw a dip in visits compared to 2024 and Costco was no exception but it did have one of the largest decreases with visits dropping by over 17% – only beaten out by Walmart which experienced a drop of 17.73%.

Costco’s best month in 2024 was December with over 62 million visitors when consumers headed to the supermarket for holiday goods. Costco experienced a great month in March 2025 as visitors increased by over 9% compared to the previous year.

3. Bashas

- Annual revenue: $1.7B (2023)

- Number of stores: 54 stores in the U.S

- Size: 5,001 – 10,000 employees (2025)

Bashas is known for its supermarket stores in Arizona. Owned by Raley’s Supermarkets, Bashas is a traditional grocery store chain with most of its stores in Arizona and New Mexico.

Bashas foot traffic performance

Like many supermarkets, Bashas saw a decrease in foot traffic in Q1 2025 however the supermarket chain experienced one of the lowest decreases of -12% compared to Q1 2024. Outside of December, Bashas best month in 2024 was May when the retailer saw an increase in traffic year-on-year of +4.98%.

At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Sign up to our newsletter so you never miss a report.

4. ALDI

- Annual revenue: $120.89 billion (Global, 2023)

- Number of stores: over 2,000 stores in the U.S

- Size: over 45,000 employees in the U.S (2025)

ALDI is known for its discount prices, good deals, and recent plans to expand in the U.S. ALDI USA reported that it is adding more than 225 new stores in 2025, the most it has launched in a single year.

ALDI foot traffic performance

ALDI had a great December like many supermarket chains. The retailer saw an increase in foot traffic year-on-year of +6.16% in December 2024. Outside of December, ALDI’s best month in 2024 was October with a +0.10% increase in traffic. The retailer has seen visits decrease across many months in 2024, however, visits were in large numbers! ALDI saw visit numbers of over 700 million in Q3 and Q4 2024.

5. Trader Joe’s

- Annual revenue: $16.5 billion (Estimate, 2023)

- Number of stores: over 2,000 stores in the U.S

- Size: over 600 employees in the U.S (2025)

Trader Joe’s a nationwide grocery chain known for its own brand items, healthier food product choices, and organic goods.

Trader Joe’s foot traffic performance

Trader Joe’s is aligned with wider foot traffic trends for supermarket visits. Many grocers saw an increase in foot traffic in Q4 2024 and Trader Joe’s saw this as well with an increase of over 3%. This is one of the lower increases for this quarter, but store brand sales rose 3.9% YoY to $271 billion in 2024, compared with just 1.0% growth for national brands, per a report from the Private Label Manufacturers Association based on Circana data.

While Trader Joe’s has experienced similar consumer trands to other supermarkets, its own brand items still bring in the vists and sales the retailer needs.

6. 7-Eleven

- Annual revenue: $79.79 Billion (2023)

- Number of stores: over 12,000 stores in the U.S

- Size: over 135,332 employees worldwide (2025)

7-Elven is known for being one the largest convenience store chains in the world while Walmart is the biggest grocery store chain globally.

7-Eleven foot traffic performance

While the general trend for consumers in Q3 2024 was visiting grocery stores less often, 7-Eleven saw one of the lowest decreases with a drop of only 1.92% in visits. Outside of December, 7-Eleven’s best month in 2024 was November where the retailer saw over 97 million visitors across its stores.

7. Safeway

- Annual revenue: $60 billion (2024)

- Number of stores: over 900 stores in the U.S

- Size: over 250,000 employees as part of Albertsons Companies

Safeway is owned by Albertsons and is known for its store locations across the West coast of America.

Safeway foot traffic performance

Safeway had one of its best months in October in 2024 when the retailer saw visits pick up by +5.83% year-on-year. In December 2024, Safeway saw over 110 million visitors across all of its stores. Our data shows that Safeway is no exception to overall consumer trends, which has seen Safeway and its competitors see an increase in visits in Q4 2024 and a drop in visits in Q1 2025 year-on-year.

At pass_by, we offer the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. Sign up to our newsletter so you never miss a report.

8. Kroger

- Annual revenue: $147.1 billion (2024)

- Number of stores: over 2,700 stores in the U.S

- Size: 414,000 employees (2023)

Kroger is known as one of the largest grocery chains in the U.S. Its many stores operate nationwide across 35 states, under two dozen umbrellas.

Kroger foot traffic performance

Kroger’s best month in 2024 was December when the retailer saw over 151 million visitors to its stores – a+4.41% increase year-on-year. Kroger also experienced a great March in 2025 with visits increasing by +4.00% year-on-year.

9. Publix

- Annual revenue: $59.7 billion (2024)

- Number of stores: over 1,300 stores in the U.S

- Size: over 255,000 employees (2023)

Publix is known for being an employee-owned supermarket chain with stores in the south of the United States.

Publix foot traffic performance

Publix’s best month in 2024 was December as visits increased by over +8% year-on-year. Visits did drop in January and February, as it did for many grocery retailers, but visits picked up again in March 2025 when Publix saw an increase in traffic of over 3% compared to the previous year.

10. Giant Eagle

- Annual revenue: $11 billion (Estimate, 2024)

- Number of stores: over 210 stores in the U.S

- Size: over 35,000 employees (2023)

Giant Eagle is known for being a regional grocery store chain and for owning fuel/convience store chain GetGo.

Giant Eagle foot traffic performance

Many supermarket chains saw an increase in foot traffic in Q4 2024 as consumers bought what they needed for the holidays. Giant Eagle had one of the lowest increases year-on-year of just over 1% and so the retailer saw little benefit in terms of visits from this consumer behaviour trend.

Overall, however, Giant Eagle has seen the lowest highs and lows overall in the past few quarters with a dip of almost 10% in Q1 2025, compared to over 16% for Walmart and over 15% for ALDI. Giant Eagle’s best month in the past year was March 2025 with a foot traffic growth rate of +8.94%.

11. Sam’s Club

- Annual revenue: $84.3 billion (2023)

- Number of stores: around 600 stores in the U.S

Sam’s Club is known for being a membership-only supermarket owned by Walmart.

Sam’s Club foot traffic performance

Sam’s Club had one of the biggest drops in visits in January 2025; the retailer saw a drop in visits of -25.81% year-on-year though this averaged to a -16.31% overall in Q1 2025 which is in line with many supermarkets. Sam’s Club’s best month was March 2025 when the supermarket chain saw an increase of +9.99%.

12. Walgreens

- Annual revenue: $147.658 billion (2024)

- Number of stores: around 8.500 stores in the U.S

- Size: over 312,000 worldwide (2025)

Walgreens is known as a leading pharmacy and drugstore retailer in the United States, offering a wide range of products and services, including prescriptions, health and wellness products, photo services, and more.

Walgreens is also known for being one of the largest chains in the U.S, competing with big names like CVS and Walmart. Walgreens saw it’s annual revenue increase in 2024 from 2023 by 6.17%.

Walgreens foot traffic performance

Walgreens followed similar trends led by consumer behaviour which saw visits decrease in Q3 2024 and Q1 2025. Walgreens was one of the few supermarkets to also see a dip in Q4 2024, though it was a small drop of 0.99% it seemed consumers chose to visit other retailers over the holidays.

pass_by offers the highest in market accuracy with 94% correlation to ground truth, over 15 data inputs, and a full 90 days of predictive feeds. To complete your analysis, book a demo.

FAQs about the top grocery store chains in thre U.S

What is the world’s largest grocery store?

Walmart is the largest grocery store not just in the States but in the world by revenue (over $600 billion) and by number of employees (over 2.3 million worldwide). This makes Walmart the largest supermarket chain in the world along with the world’s biggest private employer.

What is the biggest Walmart in the United States?

Store 2152 in Albany, New York is the largest Walmart in the United States. The store has 260,000 square foot of space spread over two floors.

What is America’s favorite grocery chain?

The 2025 American Customer Satisfaction Index ranked people’s choices for the top grocery chains and found Publix and Trader Joe’s came out on top for American customers. In the Northeast, Wegmans and ALDI were the favorite, the Midwest favored Sam’s Club and ALDI, the South favored H-E-B, Publix and ALDI, while the West preferred Trader Joe’s and Costco.